The futuristic buying spree has run its course

At the end of the year, news broke that Nissan, Honda, and Mitsubishi Motors were in merger talks, sparking speculation that this was essentially a bailout for Nissan. However, the previous year and the year before that, all Japanese automakers were celebrating unprecedentedly strong financial results. Not everyone is on the latter side of the ant-grasshopper analogy, so even though the media was reporting it in a short-term, somewhat inflammatory way, everyone was probably feeling a certain amount of dread about the prospect of a decline in demand in 2024 after the COVID-19 pandemic. On the other hand, if they were formulating short- and medium-term strategies for the mid-2020s and beyond, it would have been better for them to stick together in the long term, and that’s how things played out.

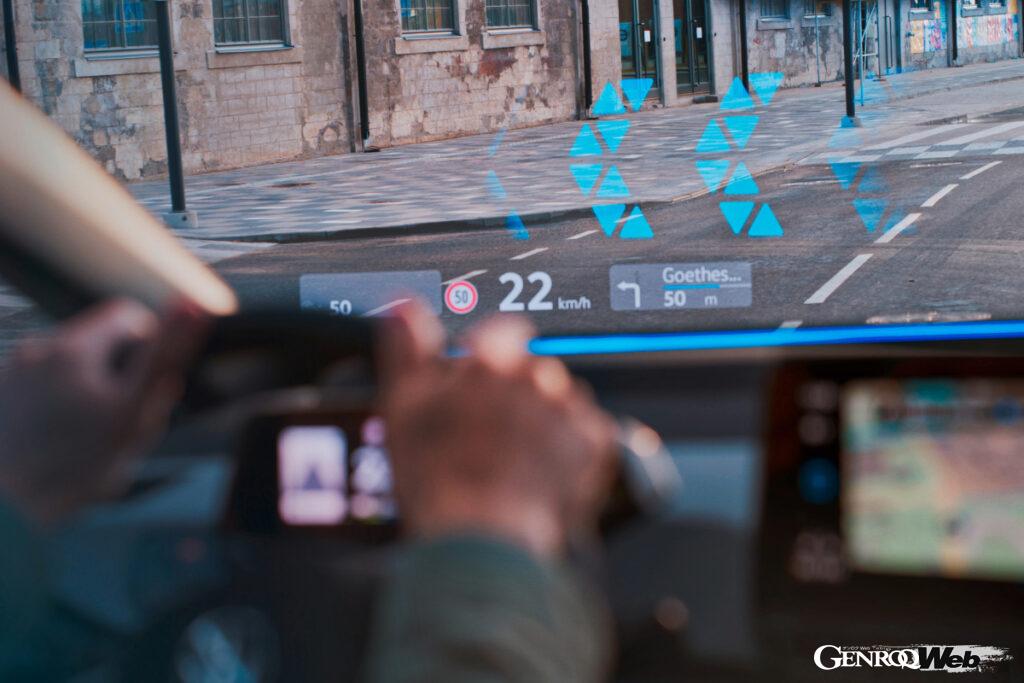

Personally, I think that around the time of the COVID-19 pandemic, autonomous driving became a dream technology, and the demand for it, fueled by the notion of a future that doesn’t exist, has now run its course. Even though it was only Level 2, the feeling that autonomous driving must be realized someday seems to be weighing on both the production side, the buyer side, and the people formulating the rules and protocols, in terms of both work and costs.

By the way, I personally suspect that the current situation where the roads in front of you get stuck every time you come across a sag on the highway, regardless of whether it’s a weekday or a weekend, is largely due to ACC traffic jams. This is the root cause of the intensification of tailgating, bad manners, and overtaking on the left, and at the same time, the development of autonomous driving is progressing, which is just making things even more confusing.

Japan’s streetscape is a dystopia

There’s a film called “Week-end,” released in 1967 by the late Jean-Luc Godard, which is like an absurdist comedy. A petty-bourgeois couple goes on a weekend drive to their parents’ house near Paris, but get caught in a huge traffic jam. In the midst of mass hysteria, bad things start happening as colorful cars pile up and lie dead on the side of the road.

Their goal, in the first place, is to poison them little by little during a weekend drive in order to speed up their inheritance. The current Japanese street scene has reached a level where this dystopia doesn’t seem like something that only happens to other people. People complain about how expensive cars have become, and feel that they are a nuisance to others, yet they are forced to invest in things that are unclear as to their true value. It’s a story of who benefits from this?

It looks like it’s not going to be possible for the time being, and I hope some OEM will just say with a cynical attitude that they can’t take responsibility. No matter how much a manufacturer assumes the worst, or how much they try to get the AI to make the best decisions, malicious people will try to go beyond that. Even if they don’t have malicious intent, pedestrians, cyclists, motorbikes, and even cars are everywhere in public spaces, not even looking ahead, due to complacency or carelessness.

Still, it’s important to get to “somewhere other than here,” and that’s why we get in the car, so at the very least we need to focus on driving to a minimum. Even if hands-off and eyes-off driving becomes a reality, is there really anything to do in the car other than looking at a smartphone or screen? No matter how productive that might be, that unproductive and wonderful moment will pass quickly.

I’m tired of new cars that are too digital

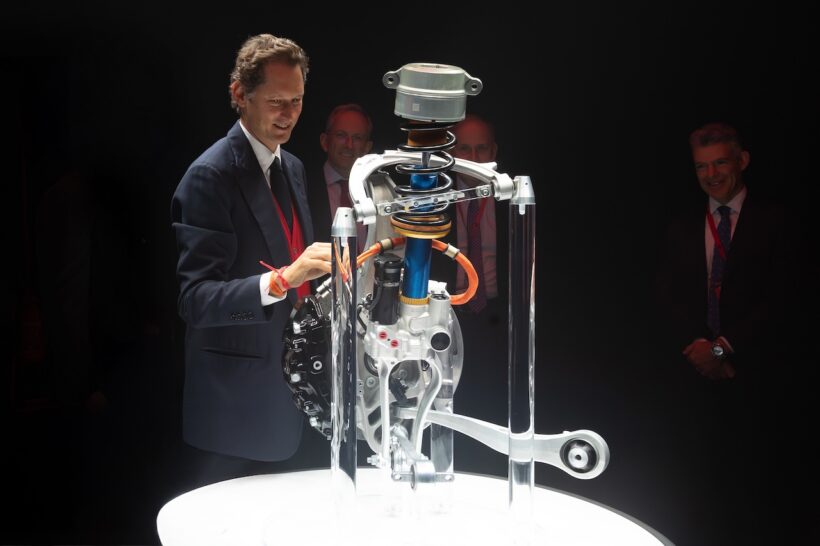

Alpine A290

The background to this tendency to lean in the direction of “who benefits?” is China’s BEV offensive and the intensifying development of SDVs, but honestly, I think users are tired of new cars with an overly digital design. Even small cars that are sure to be hits or have a good reputation have an exquisite balance of digital and analog. For example, the Mazda Roadster with its ADAS, or the Mercedes-Benz G580 with EQ Technology, which has a ladder frame but four independent motors. Like a smartphone, with a flick of your finger, you can easily do this and that, or even have it do things automatically.

Any adult with the capacity for reason and discretion wouldn’t be thrilled with such a shallow experience that involves simply tracing dotted lines. When something is described as “adult,” it’s more like something children should reach out and experience. It’s meant to be used as a tool, but it’s often bundled with peek-a-boo-style surprises, and the so-called entertainment is more like a play or a school play. Since the fiddling around is exhausting in the first place, users would likely appreciate less-optional apps and features, with the option price dropping slightly with each new one, rather than infotainment with a full complement of apps and features. In other words, we haven’t even reached the level of the early 2000s, when PC operating systems were bundled with everything and uninstalling them was a pain.

BEV beginners are switching to PHEVs

Alpine A290

Therefore, I feel that the penetration and mix of electric vehicles in the market will only progress slowly through 2025 as long as the sense of distance from digital remains strong. BEVs account for 1.5% of sales in Japan, and 3% when combined with PHEVs, but this still only accounts for 1-2 out of every 100 new cars. There will be repeat and loyal customers who choose BEVs again when it’s time to switch, but I feel that people will tend to choose smaller, more efficient vehicles. In fact, kei cars are more common in BEVs, and Asian BEVs are strong when it comes to V2H compatibility, but they are still a very small minority.

More than that, in the near term, as BEVs start to sell well and reach their first vehicle inspection, the used market is slow to take shape, meaning trade-ins are painful and people are becoming discouraged, and I think we’ll see an increase in people returning to PHEVs or internal combustion engines. Some suppliers are developing equipment to evaluate battery health, though. Conversely, people who used PHEVs will realize that they rarely use the engine and that a BEV is sufficient, so they’ll switch. We’ll likely see a reversal of course, with many new BEVs switching to PHEVs.

In other words, users will decide for themselves how much electrification they want based on how they drive and use their vehicles, and as a result, the choices they make will become smaller and smaller, leading to a resizing process. In reality, more than half of new car registrations are light vehicles, and light vehicles also account for a significant portion of BEVs. However, this is only a very small minority of users, and in reality, domestic manufacturers and importers will gradually return to a normal state where they are conscious of the remaining 97% of the market. Or rather, I hope that this will be the case.

![Will the shift from PHEV users to BEVs and BEV users to PHEVs begin? [2025 Automotive Industry Predictions]](https://wheelfeed.com/wp-content/uploads/2025/01/3941-1761202137040.jpg)