Although it is smaller than a regular passenger car

Toyota Aygo X

With Japanese minicars getting a lot of attention, Stellantis Chairman John Elkann talking about the need for “E-cars” in Europe, and President Trump reportedly giving the go-ahead for micro-compact cars, some are wondering if Japan’s Galapagos is finally going global, but that’s a bit of a fantasy. The West is simply finding a direction by creating a category standard for “less than a regular passenger car, larger than a moped” like the Japanese minicars.

What this meant was that former Renault CEO Luca de Meo wanted to relax safety standards as a prerequisite for E-cars. In essence, he was saying that in parallel with the existing European car rules, which continue to see body dimensions and costs grow in proportion to stricter safety standards, an exceptional “less than standard car” category should be established for regional commuter use.

Initially, I had predicted that the E-car category would specifically be a reevaluation of A-segment vehicles, which European manufacturers had abandoned due to the cost and difficulty of equipping them with safety equipment. This is because, at the end of 2024, GERPISA (Groupe d’études et de Recherche Permanent sur L’industrie et les Salariés de l’Automobile), a third-party organization that conducts scientific research on the state of the automotive industry, proposed type standards called “M0” and “M1” to create a new subcategory of passenger cars called ASEV (Affordable Sustainable Electric Vehicle), at the request of the European Commission.

For E-cars that are supposed to be BEVs

Twingo E-Tech Electric

According to the plan, the car would be 3.8m long, 1.7m wide, 2m high, with a wheelbase of 2.2m or less, weighing less than 1000kg, and would have the same simplified GSR 2 equipment required for a standard car. The former would have an output of up to 54PS and would be prohibited from highways, while the latter would be 68PS and would be highway-safe. This was the prototype for the E-car, and it was assumed that it would be a BEV.

Then, in the first half of 2025, the Stellantis Group announced that it would convert the Fiat 500e, whose sales had already peaked, to a 12V MHEV + MT specification, which was released to the market in the second half of the same year.

Around the same time, the European Commission began to consider revising its goal of achieving zero-emissions new cars, meaning the end of sales of ICE vehicles, by 2035. So, it seemed that European automakers would push for a compromise, with ASEVs (Affordable Sustainable Electrified Vehicles) gradually moving in the direction of including electric vehicles, not just BEVs, in the category of e-cars.

Disappointment with the much-discussed E-car

Twingo E-Tech Electric

Then, on December 16th, the European Commission announced comprehensive but revised guidelines for the future, called the “Automobile Package.” For the time being, the ban on new ICE vehicle sales from 2035 was lifted, on the condition that CO2 emissions are reduced by 90% compared to 2021. Thus, both hybrids and pure ICE vehicles will partially survive.

However, the E-car standard called “M1E” announced at the same time will remain valid for the next 10 years, and will cover compact BEVs with a total length of less than 4.2m. In other words, E-cars are equivalent to B-segment cars, not A-segment cars, and are more than twice the size of Japanese minicars. Specific examples include the Opel Corsa, Fiat Grande Panda, Renault 5 E-Tech, Peugeot 208, and the upcoming VW ID Polo.

No indication has yet been given of what kind of safety equipment will be simplified and how costs will be reduced to achieve the targeted price of 15,000 to 20,000 euros. Disappointment is swirling across the European internet that the much-talked-about E-car is actually a BEV that is already on the European market.

Guidance towards compact European-made BEVs

Twingo E-Tech Electric

It was thought that it would be unlikely for Europe, where the normal speed range is already high, to go to the trouble of creating rules and an environment specifically tailored to light vehicles, but rather than drawing funds and efforts back into the A-segment in terms of investment efficiency, the country has decided to move in a direction that will allow European automakers and infrastructure companies to recover the development costs they have already invested.

The plan also includes measures to encourage the use of low-emission steel and battery cells made in Europe. While we will have to wait for the announcement of the “Amendments to European Resolution 2018/858,” expected early next year, it also includes tax breaks and preferential treatment on highways and parking fees specific to e-cars, guiding local governments and users toward “compact, European-made BEVs.” Additionally, e-cars are counted 1.3 times more toward CO2 emissions credits, so the more e-cars sold, the stronger the foundation for automakers to continue producing sports models and other products.

Simply put, the EU recognizes the need for affordable BEVs, but there is no need to copy Japanese minicars. At the same time, it has decided to continue developing the competitiveness of the European automotive industry while putting a certain price cap on Chinese-made BEVs.

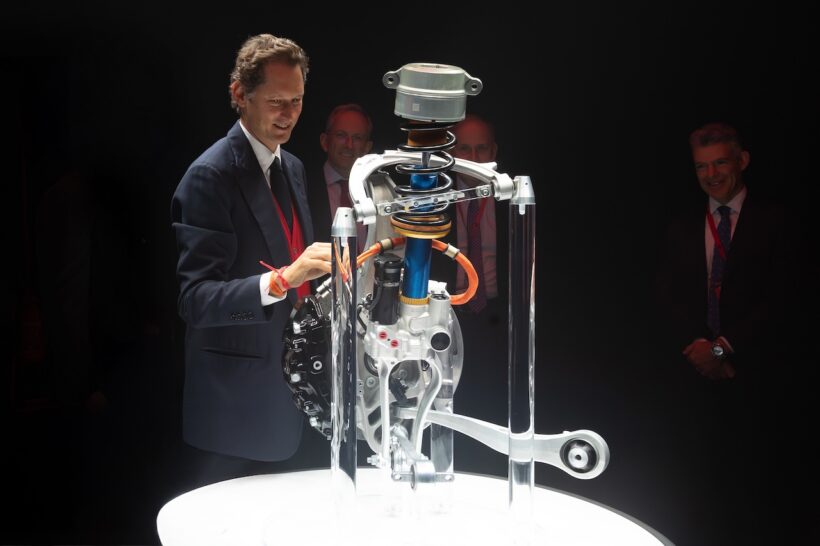

Toyota’s shrewd strategy

Toyota ProAce City

The new A-segment models that are already on the way have had mixed results for each manufacturer. Renault, which announced a BEV version of its fourth-generation Twingo, reminiscent of the first generation, in mid-November with plans to launch it on the market in 2026, and VW, which is preparing the ID.Every 1, are among the manufacturers that have come under scrutiny. However, the Stellantis Group, which has already launched the 65 PS, 95 Nm Fiat 500 Hybrid, has come under scrutiny.

However, one company that is likely to benefit from the establishment of the M1E category is Toyota, which produces the Toyota Aygo X, the first full hybrid vehicle in the European A-segment, at its Czech factory. If the Aygo X is converted into an BEV while securing the procurement of batteries and steel within Europe, it will naturally become an e-car. However, for certain users who continue to face the bottleneck of needing a charging environment at home or nearby, it is unclear how much preferential treatment they will receive in terms of maintenance and usage costs, and it is unclear whether e-cars will be a solution. In other words, the possibility that strong hybrids will gain an advantage in the market has not yet been eliminated.

Another shrewd move by Toyota is that the Toyota ProAce City shares a platform with and is produced at Stellantis’ Vigo plant in Spain, alongside the Citroën Berlingo and Peugeot Partner. This marks the second collaboration in the commercial vehicle space, following the Citroën Jumpy, Peugeot Expert, and Toyota ProAce, which were built in the larger segment in 2016. Naturally, this also paves the way for the shift to BEVs in commercial vehicles.

The light tax system should be expanded to include the 5-number frame.

Toyota Aygo X

It is unclear whether the “M0” model for E-cars, a format that cannot enter highways, has been dropped or whether a new one will be announced in the future. In fact, it is a useful reference point for Japan, where light vehicles now account for half of all new car registrations in the country. Partial control over light vehicles’ access to highways would have benefits in terms of safety, the environment, and industry. Light vehicles and their tax systems are necessary as a safety net, but we must once again recognize that they are commuter vehicles smaller than standard cars. There is now room for review of passive safety features such as B-pillarless vehicles and crash test methods.

Rather, it would be more productive to expand the tax system for kei cars up to around the 5-number limit in order to encourage domestic manufacturers to develop compact cars that have a high speed range and can be used even in the future, even if weight energy increases with the shift to BEVs. On the other hand, in order to keep existing kei cars as their original purpose of local commuter vehicles, the direction is to make them more expensive than standard cars with ETC the longer they travel on highways from their registered area.

As a result, more and more people will realize that the sight of light high-roof wagons and trucks squeezing each other in the passing lane like they’re playing Tetris or something is more than just comical; it’s barbaric and uncivilized.